by Mahmud Tim Kargbo

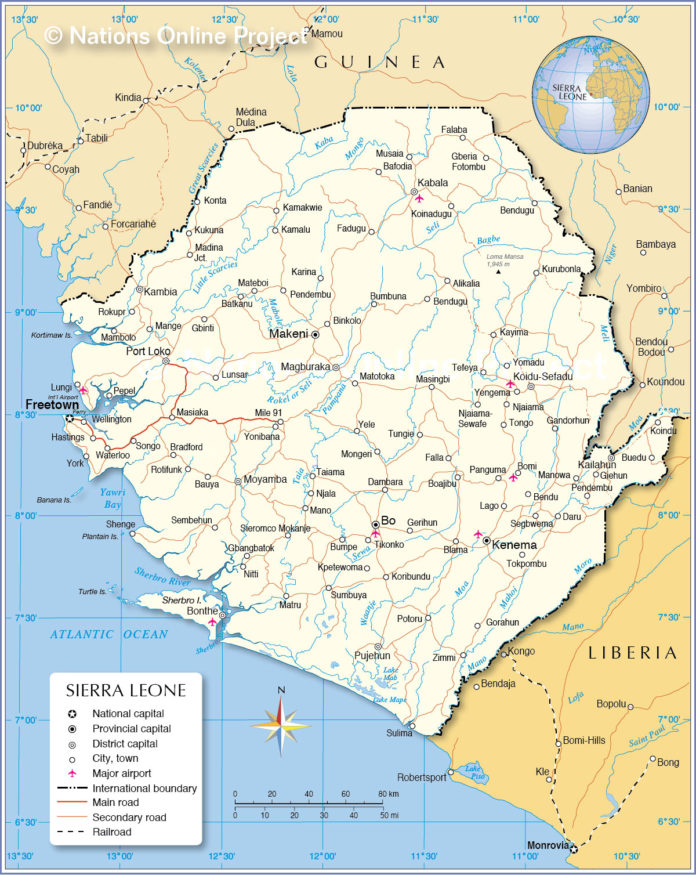

In the years following the financial crisis, international regulatory measures have increased substantially. But recent reforms (Basel III is one example that comes to mind), governments in countries seriously affected by massive poverty like the government of Sierra Leone, need to focus more on detailed procedures and processes rather than successful outcomes. Not to mention most of these regulatory changes have been made or substantially transformed on the national scale, without expressed regard to national implications.

So why does this matter to the current Sierra Leone government?

Well, without clear, uniform, and appropriately focused global regulation, economic growth is likely to stall and financial stability for all becomes harder to achieve especially for poor nations like Sierra Leone which still has a high rate of corruption, poor infrastructure, the politicisation of the civil service, removal of experienced civil servants from the civil service sector after a change of government, lack of skilled labour, weak protection of other democratic values and the possibility of contacts being cancelled on a whim. Relatively few people have reaped the rewards of economic prosperity. And that’s a problem. The current environment is creating incentives for risk-adding behaviours, such as structuring transactions to circumvent regulatory barriers, an overly-narrow focus on compliance, and increased activity in less regulated areas such as shadow banking.

This cost and complexity of process-oriented regulation have also resulted in oligopolies among the few organisations that are grappling to keep up in Sierra Leone. Heads of smaller organisations I spoke to, said this creates an important impediment to growth. Many cite a gap emerging between regulations on the books and those are that enforced. This creates a fragmented system where organisations essentially choose what regulations they follow, thus creating new and invisible risks within the system.

Similarly, the environment is also having an impact on the talent pipeline. Young people and high-potential talent said to me they are beginning to see roles as compliance-oriented, rather than strategic and business-focused. The regulatory focus is also limiting the pipeline of personnel in governance and regulatory roles; senior financial and accounting professionals who could bring deep experience to regulatory jobs often resign or sit in their offices in frustration.

It will be recalled that in this past December, while there has been global agreement on some regulation, over 50 executives and experts from civil societies, business, journalists, finance, and accountants joined together to figure out how to reconcile the gap between a globalised business and finance industry and the predominantly ‘national interest’ approach to many regulations.

The roundtable, hosted by IFAC and the Hong Kong Institute of Certified Public Accountants sent a clear message to the regulatory industry: we need global reform, now. Attendees from all sectors voiced their concerns that the current structure is limiting both innovation and growth. As one of our colleague participants said: “The costs involved with an idea have become so complex, it’s no longer worth the effort.”

So what can we do?

The meeting ended with roundtable participants agreeing on ten principles that they believe are the path forward towards a global regulatory system:

- Clear Objectives in the Public Interest: All regulations should be set for the benefit of the public where they are to be effected

- Proportionate and Balanced Approach: Regulations should be applied for different types and sizes of organisations

- Evidence-Based Assessments: All regulations should be subject to ongoing evaluations to determine the effectiveness of cost and time

- Appropriate Resourcing: Ensure regulators have the resources needed to address the complexity and scale of the corporations and markets they are expected to regulate

- Collaborative Action: Provide robust incentives for collaboration in order to create country-based regulatory ecosystems

- Consistent & Coherent: Address the gap in consistent regulatory systems

- Transparent & Open: Broad transparency during the regulation development process that allows all impacted parties to be involved and share insights about potential implications

- Active Oversight: More active and independent oversight of regulators

- Systematic Review: Ongoing reviews and evaluations of how new regulations are performing

- Deliberate Enforcement: Ensure that the enforcement of new regulations are fair and visible

As right-minded nationals push regulators to consider their impact in Sierra Leone, we also hope to drive them to further embrace these key principles to ensure the right environment is in place for sustainable economic growth nationally and globally. Nationals are urged to consider the role regulation plays in setting that stage for genuine growth in Sierra Leone.